Uneconomical Trust

Http Tcms Njsba Com Personifyebusiness Portals 4 Webinars 8 16 16 Effect of utc on special needs materials Pdf

Peak Trust Which Jurisdiction Is Right For You

West Palm Beach Trust Reformation Attorney Todd A Zuckerbrod P A

Http Www Cobar Org Portals Cobar Tcl October 18 Cl October Features Te Pdf

Microsoft Word Ira Trust Template

Static1 Squarespace Com Static 5807a480d4e9eb1f5d9c54 T 5d86b7e58cd5b624c 14 Irrevocable Trusts Non Judicial Settlements Pdf

(A) (1) Except as provided in division (A)(2) of this section, after notice to the qualified beneficiaries, the trustee of an inter vivos trust consisting of trust property having a total value of less than one hundred thousand dollars may terminate the trust if the trustee concludes that the value of the trust property is.

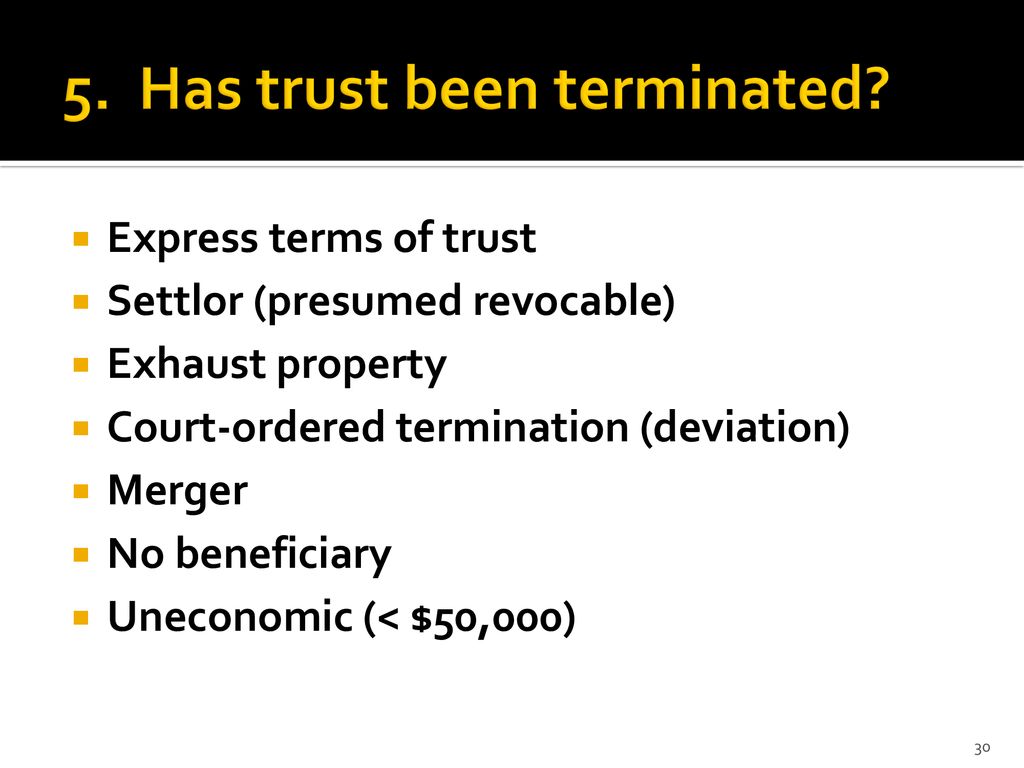

Uneconomical trust. 28, 18, trustees are able to terminate “uneconomic” trusts that have trust property with a value less than $250,000. Galt, 511 F.2d 504, 510 (7th Cir.1975);. 701.0407 Evidence of oral trust.

After notice to the qualified beneficiaries, the trustee of a trust consisting of trust property having a total value less than $100,000 may terminate the trust if the trustee concludes that the value of the trust property is insufficient to justify the cost of administration. (1) Any trustee or beneficiary of a lifetime or testamentary express trust (other than a wholly charitable trust) may, by application to the surrogate's court having jurisdiction over the trust, seek a termination of such trust when the expense of administering the trust is uneconomical. A GST protects the family’s wealth from all of these scenarios, because the grantor’s children will have absolutely no legal authority to use the trust assets as collateral.

If a trust has less than $50,000 in assets, the trustee may terminate the trust without getting court approval. (a) After notice to beneficiaries who are distributees or permissible distributees of trust income or principal or who would be distributees or permissible distributees if the interests of the distributees or the trust were to terminate and no powers of appointment were exercised, the trustee of a trust consisting of trust property having a total value of less than $50,000 may terminate the. Thus the trustee must administer the trust in strict accordance with the trust's terms and the settlor's intent as expressed in the trust instrument.

In Texas a Trustee may decide that a Trust holding $50,000 or less is an uneconomical trust, terminate the Trust and distribute whatever it holds to the beneficiaries. 736.0414 Modification or termination of uneconomic trust. 701.0406 Creation of trust induced by fraud, duress, or undue influence.

Teamsters Local 2 Pension Trust Fund v. 5804.14 Termination or modification where costs exceed value. TERMINATION OF UNECONOMIC TRUST.

The trust purpose becomes impossible to fulfill, or ;. This kind of trust also protects the grantor’s children from all types of financial calamities, including divorces, failed businesses, medical bills, and financial debt. 1 In most cases, these terminations or modifications must be made by a court, but in two instances, a trustee may have that authority.2 Some of these rules represent a.

Uneconomical Trust Massachusetts law also allows the termination of an irrevocable family if the total value of the trust is so low that continuing to operate the trust becomes impractical. 701.0409 Noncharitable trust without ascertainable beneficiary. A trust exists, and its assets shall be held, for the benefit of its beneficiaries in accordance with the interests of the beneficiaries in the trust.

The purpose of the trust is fulfilled. It will also be easier to terminate small trusts that are uneconomical given the value of trust assets compared to the administrative costs to run it (there are annual accounting fees as well as. (a) Unless otherwise provided by the terms of the trust instrument, and subject to the other subsections of this section, a trustee of a trust (other than a trustee who is a settlor or beneficiary of the trust or who may be removed as trustee, by action of 1 or more settlors or beneficiaries and replaced as trustee, by action of the person or.

Terminating a Trust Because it Has Become Uneconomical to Continue. Modification of the trust. (a) After notice to beneficiaries who are distributees or permissible distributees of trust income or principal or who would be distributees or permissible distributees if the interests of the distributees or the trust were to terminate and no powers of appointment were exercised, the trustee of a trust consisting of trust property having a total.

The trust purpose becomes unlawful. Decanting of the trust. 5804.05 Purposes of charitable trust - enforcement.

(b) Except as provided by Subsection (c) of this section, a trust terminates if the legal title to the trust property and all equitable interests in the trust become united in one person. (3) This code does not apply to any land trust under s. Proceedings for approval or disapproval.

In doing so, the Code preserves much of our past statutory and common trust law and fill in many of the. Under the ITC, as with prior Illinois law, a trustee may terminate any trust under $100,000 if it determines that it is uneconomical to continue the trust. Arkansas Code § 28-73-414 - Modification or Termination of Uneconomic Trust (a) After notice to the qualified beneficiaries, the trustee of a trust consisting of trust property having a total value less than one hundred thousand dollars ($100,000) may terminate the trust if the trustee concludes that the value of the trust property is.

Virginia allows for termination of uneconomical trusts without court approval if the total value of the trust is (i) under $100,000, and (ii) the trustee determines that the value of the trust property is insufficient to justify the cost of administration. April 19, 12 Living Trust, Trust Administration Jim. § 7-1.19 Application for termination of uneconomical trust (a) Notwithstanding sections 7-1.5 and 7-2.4 of this article or any other contrary provision of law:.

This banner text can have markup. It’s never too early to plan for your future. (3) Notice of any proceeding to terminate or modify a trust must be given to the settlor, the settlor's representative if the petitioner has a reasonable basis to believe the settlor is an incapacitated individual, the trust director, if any, a powerholder described in subsection (1)(b) or (c), if any, the trustee, and any other person named in.

Terminating a California irrevocable trust because it has become uneconomical. (Note that a trust agreement may provide a different threashold value for a small trust termination. Disclaimer 112.011 Posthumous Class Gifts Membership 112.031 Trust Purposes 112.032.

After notice to the qualified beneficiaries, the trustee of a trust consisting of trust property having a total value less than $100,000 may terminate the trust if the trustee concludes that the value of the trust property is insufficient to justify the cost of administration. On June 18, 09, Governor Jennifer Granholm signed into law the legislation enacting the Michigan Trust Code. The court may modify or terminate a trust or remove the trustee and appoint a different trustee if it determines that the value of the trust property is insufficient to justify the cost of administration.

Search metadata Search text contents Search TV news captions Search radio transcripts Search archived web sites Advanced Search. (a) After notice to the qualified beneficiaries, the trustee of a trust consisting of trust property having a total value of less than fifty thousand dollars ($50,000) may terminate the trust if the trustee concludes that the value of the trust property is insufficient to justify the cost of administration. Enforcement § 406 Creation of trust induced by fraud, duress, or undue influence § 407 Evidence of oral trust § 408 Trust for care of animal § 409 Noncharitable trust without ascertainable beneficiary § 410 Modification or termination of trust;.

A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. 701.0408 Trust for care of animal. Includes real and personal property.

Schedule a Consultation Today. "Our companies have a long history, back to the 1940s," Padnos said. (d) If a trust terminates under subsection (b), the trustee shall distribute the trust property in a manner consistent with the purposes of the trust.

(a) After notice to beneficiaries who are distributees or permissible distributees of trust income or principal or who would be distributees or permissible distributees if the interests of the distributees or the trust were to terminate and no powers of appointment were exercised, the trustee of a trust consisting of trust property having a total value of less than $50,000 may terminate the trust if the trustee concludes after. 701.0410 Modification or termination of trust;. The trust instrument sets forth the terms of the contract and the applicable state statutes and common law fill in any terms to the extent the governing trust document is silent.

By default, a Florida trust created after July 1, 07 is a revocable trust and can be fully amended or restated by the settlor unless the trust expressly states otherwise. Generally, the same rules that apply for trust termination also apply for trust modification. Trusts can be arranged in may ways and can specify exactly how and when the assets pass to the beneficiaries.

In California, a trust terminates when any of the following occurs:. After notice to the beneficiaries, the trustee of a trust that consists of trust property having a total value of less than $100,000 or that is uneconomical to administer may terminate the trust if the trustee concludes that the value of the trust property is insufficient to justify the cost of administration. Because the ITC is the default rule, the terms of the trust agreement will control.).

A trust governed at its creation by this chapter, former chapter 737, or any prior trust statute superseded or replaced by any provision of former chapter 737, is not a land trust regardless of any amendment or modification of the trust, any. This subtitle does not invalidate a trust account validly created and in effect under Chapter 113, Estates Code. 30 In such instances, the trustee can terminate the trust after he provides notice to the qualified beneficiaries.

The term of the trust expires. Modification or termination of uneconomic trust. Angelos, 815 F.2d 452, 456 n.

Modification or termination of uneconomic trust. The purpose of the trust is fulfilled. (1) After notice to the qualified beneficiaries, a trustee may terminate a trust if the trustee concludes that the value of the trust property is insufficient to justify the cost of administration.

Texas Property Code 112.059 – Termination of Uneconomic Trust. Terms Used In Missouri Laws 456.4-414 Property:. § 404 Trust purposes § 405 Charitable purposes;.

The term of the trust expires. In this instance, it is the policy of the Commissioner of Accounts that prior discussion, and approval of the early termination of the trust, is required. The trust is revoked.

If the trust ends, the trustee will continue to act as trustee until s/he finishes up the affairs of the trust. 112.001 Methods of Creating Trust 112.002 Intention to Create Trust 112.003 Consideration 112.004 Statute of Frauds 112.005 Trust Property 112.006 Additions to Trust Property 112.007 Capacity of Settlor 112.008 Capacity of Trustee 112.009 Acceptance by Trustee 112.010 Presumed Acceptance by Beneficiary;. § 7-1.19 Application for termination of uneconomical trust (a) Notwithstanding sections 7-1.5 and 7-2.4 of this article or any other contrary provision of law:.

Trustees will still be required to provide the appropriate notices to certain beneficiaries, and they will need to continue to weigh the advantages of holding the property in trust for tax, asset protection, divorce, or other purposes. 31 Once the trust has been terminated, the trustee is required to distribute the remaining property in a “manner. After notice to the qualified beneficiaries, the trustee of a trust consisting of trust property having a total value less than one hundred thousand dollars may terminate the trust if the trustee concludes that the value of the trust property is insufficient to justify the cost of administration.

A trustee can terminate a trust if it's relatively small ($100,000 or less) or if it's uneconomical to maintain it ($5,000 annual trustee fees on a $0,000 trust) or, in legalese, if it doesn't. See Missouri Laws 1.0. Failure to actively disclose illegal conduct, or mere denial of wrongdoing, does not qualify as an affirmative act of concealment.

Unless the settlor made the trust irrevocable when s/he created the trust, the settlor can cancel or change the trust. Modification or termination of uneconomic trust. Modification or termination of uneconomic trust (a) After notice to the qualified beneficiaries, the trustee of a trust consisting of trust property having a total value of less than $0,000 may terminate the trust if the trustee concludes that the value of the trust property is insufficient to justify the cost of administration.

Chapter 4 of Ohio Trust Code, and specifically, Ohio Revised Code Sections 5804.10 through 5804.17 provide a series of interrelated rules governing when a trust may be terminated or modified other than by its express terms. Can a trust be canceled or amended?. In California, a trust terminates when any of the following occurs:.

2 When it becomes effective on April 1, 10, the Michigan Trust Code will provide the citizens of Michigan with a comprehensive codification of the law of trusts. One provision of the UTC allows for the termination of an "uneconomical trust", in the discretion of the trustee, after notice of intent to terminate to the beneficiary(ies). If a trust terminates under this subsection, the court shall direct the trustee to distribute the trust property in a manner consistent with the purposes of the trust.

February 4, 18 Living Trust, Trust Administration Jim. Proceedings for approval or disapproval. (1) After notice to the qualified beneficiaries, the trustee of a trust consisting of trust property having a total value less than $50,000 may terminate the trust if the trustee concludes that the value of the trust property is insufficient to justify the cost of administration.

Learn more about trusts and how they can help you in estate planning. If a trust is terminated under these provisions, the trust property is distributed as determined by the court’s order. The trust purpose becomes unlawful.

The trustee will be required to give notice to beneficiaries and distribute the trust assets in a. These trusts may be considered uneconomical because the cost of administering the trust is too high in proportion to the trust assets. 6.071, except to the extent provided in s.

(A) A charitable trust may be created for the relief of poverty, the advancement of education or religion, the. By law, a trustee is authorized to terminate a trust if its value is less than $0,000 and the administrative costs make it no longer possible to effectively carry out the trust's terms. (1) Any trustee or beneficiary of a lifetime or testamentary express trust (other than a wholly charitable trust) may, by application to the surrogate's court having jurisdiction over the trust, seek a termination of such trust when the expense of administering the trust is uneconomical.

13 Estate Planning Seminar

The History Of Louisiana Trust Law From 18 To 18 And Beyond Ppt Download

Http Www Suefordyce Co Nz Documents Familytrustsguide Pdf

Colorado Uniform Trust Code Ppt Download

Www Mass Gov Doc Petition To Terminate A Trust Mpc 267 Download

Www Probateprince Com Articles Newsletters Termination Trusts Pdf

2

Www Legis Nd Gov Cencode T59c12 Pdf

Nysba Org Nysba Coursebooks Spring 17 cle coursebooks Anatomy of a trust Bk Pdf

2

Legal Terms Related To Wills And Trusts Estates And Probate The Garrett Law Firm

Microsoft Word Ira Trust Template

Microsoft Word Ira Trust Template

Those Pesky Trusts A Brief Primer On Terminating Unwanted Trusts Farrow Gillespie Heath Witter Llp Dallas Tx

Microsoft Word Ira Trust Template

Chapter 44 Wills Estates And Trusts Davidson Knowles Forsythe Business Law Cases And Principles In The Legal Environment 8 Th Ed Ppt Download

Www Pba Edu Docs Library Palmbeachatlanticuniversity15 Learn Well Lw Alumni An overview of trust modification and decanting Pdf

13 Estate Planning Seminar

Q Tbn 3aand9gcsuwydt4vacofnalhtmhovclouyl3puuwiyr0u36la0tdvsdsig Usqp Cau

What Are A Trust Beneficiary S Rights To Information About A Trust Hickman Lowder Co Lpa

Http Ideaexchange Uakron Edu Cgi Viewcontent Cgi Article 1150 Context Ua Law Publications

3

2

Http Lataxlawyers Com Uploads General Estate Planning Article Dec 12 Pdf

Trust Law Wikipedia

Www Cobar Org Portals Cobar Tcl 19 March Cl Feat Te Pdf

Http Www Vsb Org Docs Conferences Senior Lawyers Utc 401 Pdf

Www Mcbhawaii Marines Mil Portals 114 Webdocuments Legal Will application packet 1 6 10 Pdf

Can You Trust Your Trust A Review

When Does My Family Trust Terminate

2

Irrevocable Trusts Can I Revoke It Elisabeth Pickle Law P L C

Microsoft Word Ira Trust Template

Microsoft Word Ira Trust Template

Http Lataxlawyers Com Uploads General Estate Planning Article Dec 12 Pdf

Http Www Uasf Org Bw Wp Content Uploads 16 10 Uasf Deed Of Trust Pdf

2

Reliable User Friendly Trust Amendment Termination Charts For The Busy Practitioner Florida Probate Trust Litigation Blog

Http Scholarship Law Wm Edu Cgi Viewcontent Cgi Article 1496 Context Facpubs

Http Www Nysba Org Legislativereport16

Amended Declaration Of Trust

Q Tbn 3aand9gcrij9q5qdsa8qod1bgvu0voigexj Ql8exkd1qstgfpi3dkwebn Usqp Cau

Estate And Asset Protection Planning In New York An Overview Of Trusts Lorman Education Services

Drafting A Trust To Allow Pre Termination Or Modification Video Lorman Education Services

Who Would Have Thought Charitable Trusts As A Viable Entity Darren B Moore Pdf Free Download

Www Andoverlaw Com Wp Content Uploads 18 07 Trust Presentation 2 2 Pdf

How To Kill An Irrevocable Trust

Small Trust Termination Limit Increases In Missouri Preservation Family Wealth Protection Planning

2

Www Mass Gov Doc Mutc Procedural Advisory Download

Hcf Testamentary Language 7 19 17 By Hawaii Community Foundation Issuu

De Register My Trust The Trust Company Inc

Fixing Old Trusts And Exploiting New Opportunities Florida S Decanting Statute Pdf Free Download

Page 37 Phg Q A Eng Indd

Budget Must Aim At Regaining Trust Important For Government To Implement What It Has Promised So Far The Financial Express

Http Lataxlawyers Com Uploads General Estate Planning Article Dec 12 Pdf

Http Www Uasf Org Bw Wp Content Uploads 16 10 Uasf Deed Of Trust Pdf

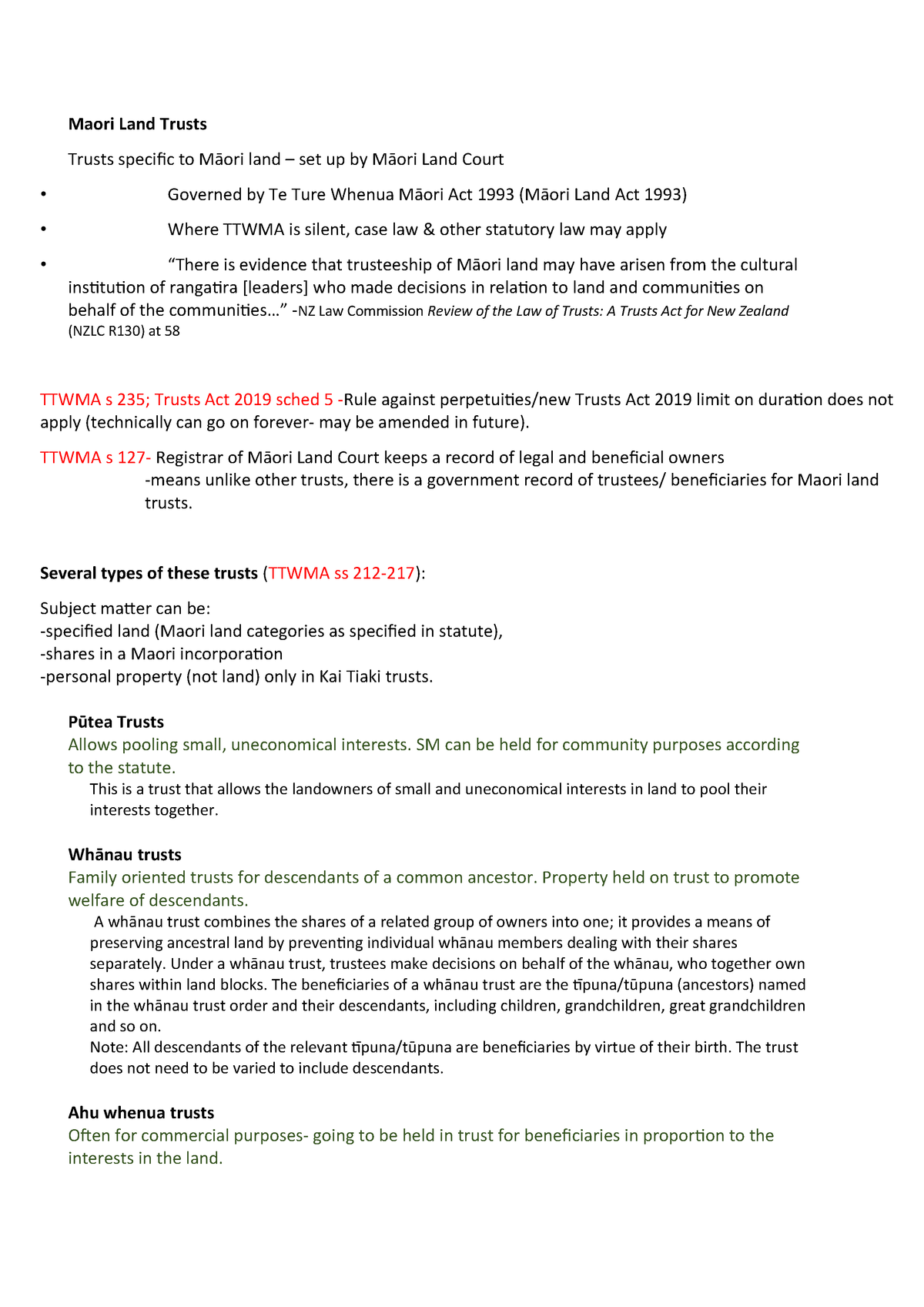

Maori Land Trusts Lecture Notes 12 Laws301 Ucnz Studocu

Q Tbn 3aand9gcqpk6hofkevnangaq87avilduwyeefe8x17lltlpoopqcilohfh Usqp Cau

Microsoft Word Ira Trust Template

Http Chicagotrustee Org Resources Documents Trust cba proposed illinois trust code final draft nov 15 Pdf

2

Final Exam Review Session Ppt Download

When Does My Family Trust Terminate Finglobal

Amended Declaration Of Trust

Pdf Trust Determinants And Outcomes In Global B2b Service

Connecticut Revamps Trust Laws Opening Door To Tax Savings And More

Http Www Uasf Org Bw Wp Content Uploads 16 10 Uasf Deed Of Trust Pdf

Eforms Com Images 17 06 Guide To Understanding Nebraska Uniform Trust Code Pdf

Http Www Saepc Org Assets Councils Southernarizona Az Library Margaret sager handout giving your trust a facelift 3b trust modification Pdf

Stocks With Monthly Dividends Hugoton Royalty Trust The Motley Fool

Trust Butler Cloud Based Ilit Administration

Http Www Uasf Org Bw Wp Content Uploads 16 10 Uasf Deed Of Trust Pdf

Microsoft Word Ira Trust Template

Chapter Trust Administration Trustee Powers Duties Liability Ppt Download

Amended Declaration Of Trust

How To Terminate A Trust King Law

Best Irrevocable Trust Asset Strategies 18 New Estate Planning Tax Laws

California Trust Administration Legal Resources Ceb Ceb

Project Information Document Pid

United States Trust Law Wikipedia

Http Tcms Njsba Com Personifyebusiness Portals 4 Webinars 8 16 16 Effect of utc on special needs materials Pdf

2

Amended Declaration Of Trust

Powerpoint Presentation Focusky

Nysba Org App Uploads 02 Final Te Utc Pdf

Www Farrellfritz Com Wp Content Uploads Article 567 Pdf

Eforms Com Images 17 06 New Jersey Uniform Trust Code Pdf

Irrevocable But Not Unchangeable A Brief Summary Of Trust Modification Methods Grant Fridkin Pearson

Chapter 19 Estate Planning Core Principles And Practice Pdf Free Download

Irrevocable But Not Unchangeable A Brief Summary Of Trust Modification Methods Grant Fridkin Pearson

Trust Me Practical Advice For Drafting Florida Trusts The Florida Bar

2

Http Www Uasf Org Bw Wp Content Uploads 16 10 Uasf Deed Of Trust Pdf

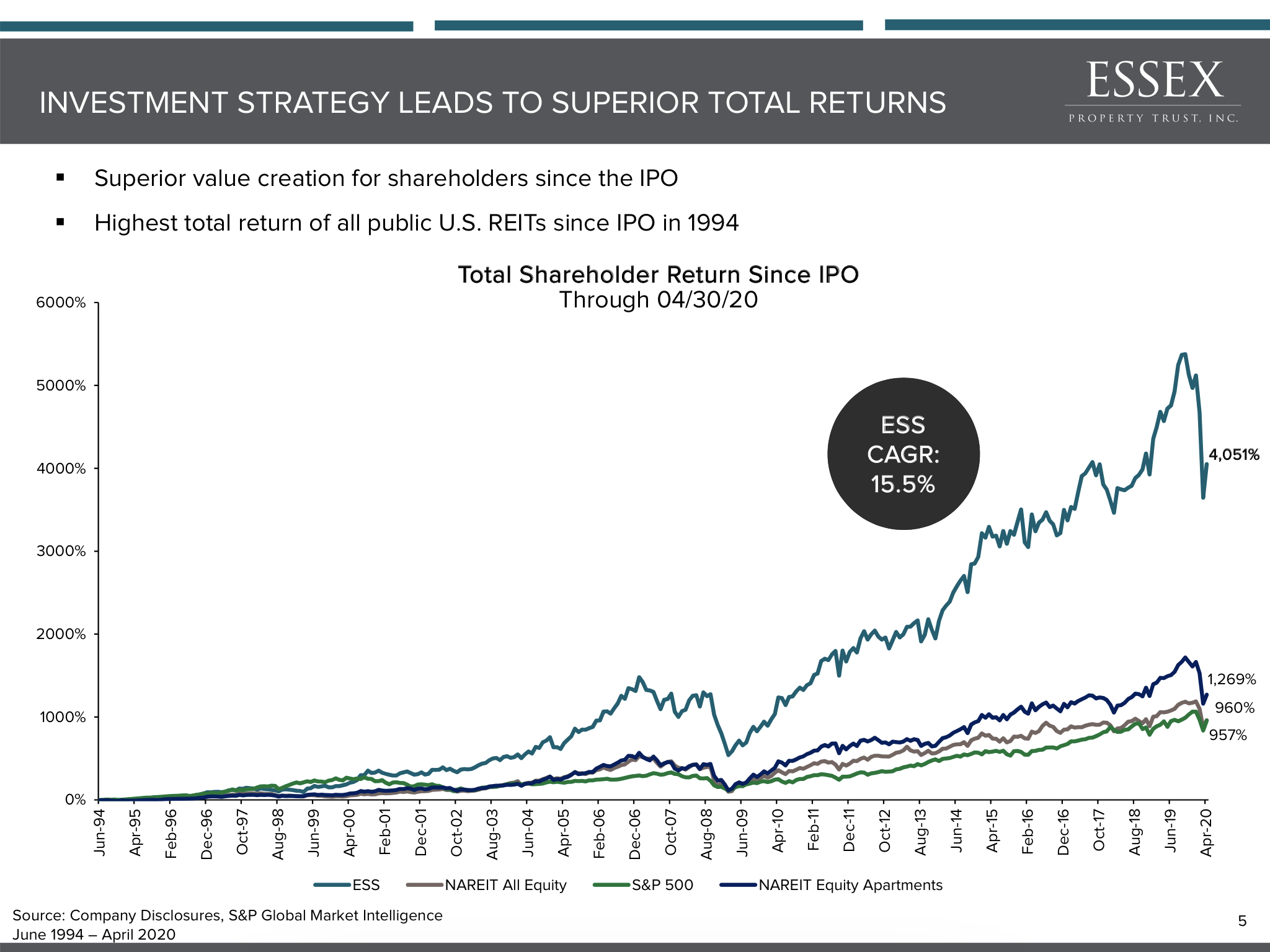

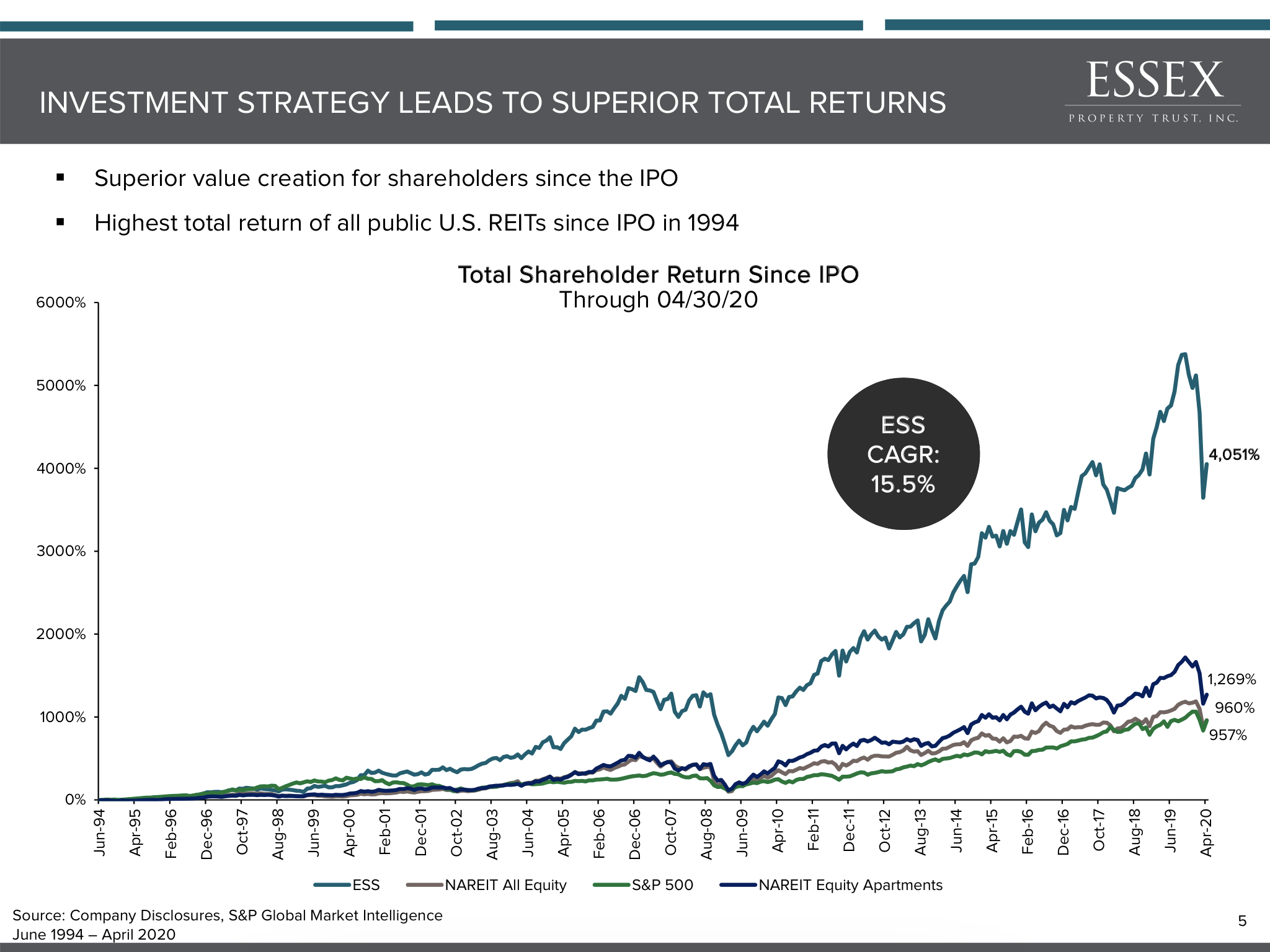

Essex Property Trust Why This Reit Is My Largest Position Nyse Ess Seeking Alpha

Microsoft Word Ira Trust Template

Www Rudmanwinchell Com Wp Content Uploads 06 Modification Of Irrevocable Trusts 6 10 Pdf

Virginia State Bar Trusts And Estates Section