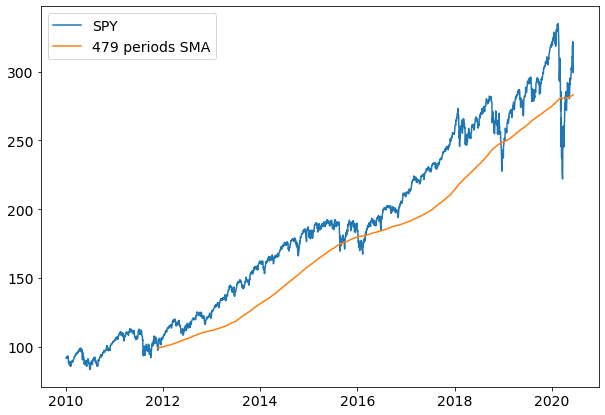

Spy 100 Day Moving Average

6 Tips For How To Use The 50 Day Moving Average

Slope Chartschool

Spy 0 Point Close 8 0 Weekly Ma Rsi Approaching Oversold For Amex Spy By Azizkhanzamani Tradingview

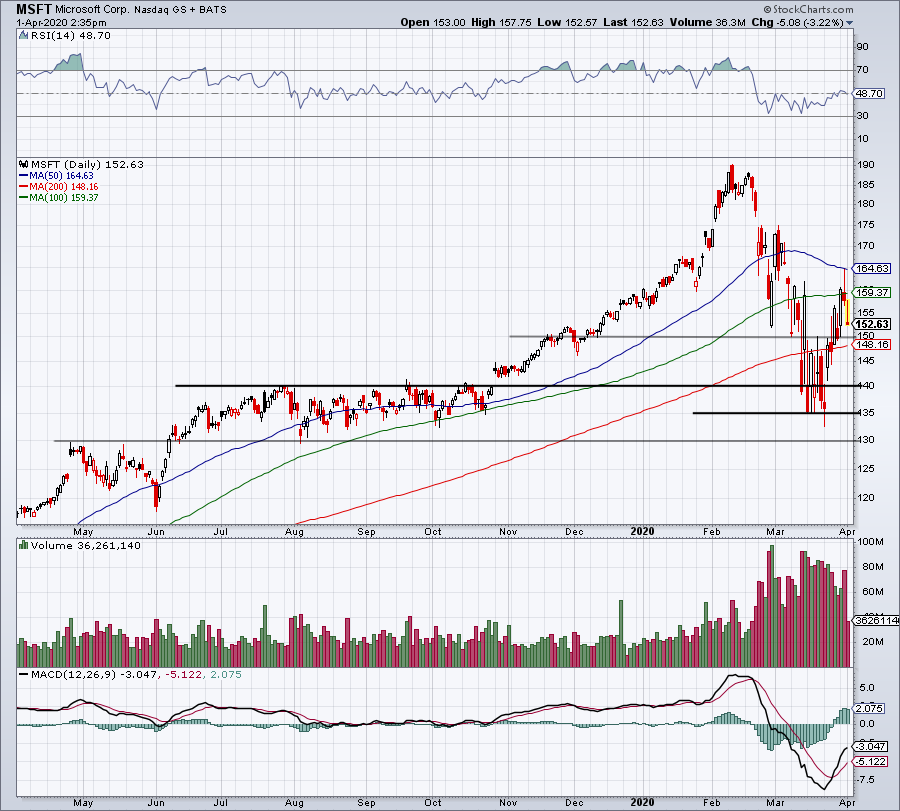

Money Movers Report Weak Global Data Brexit Snaps Three Day Streak Money Movers Report

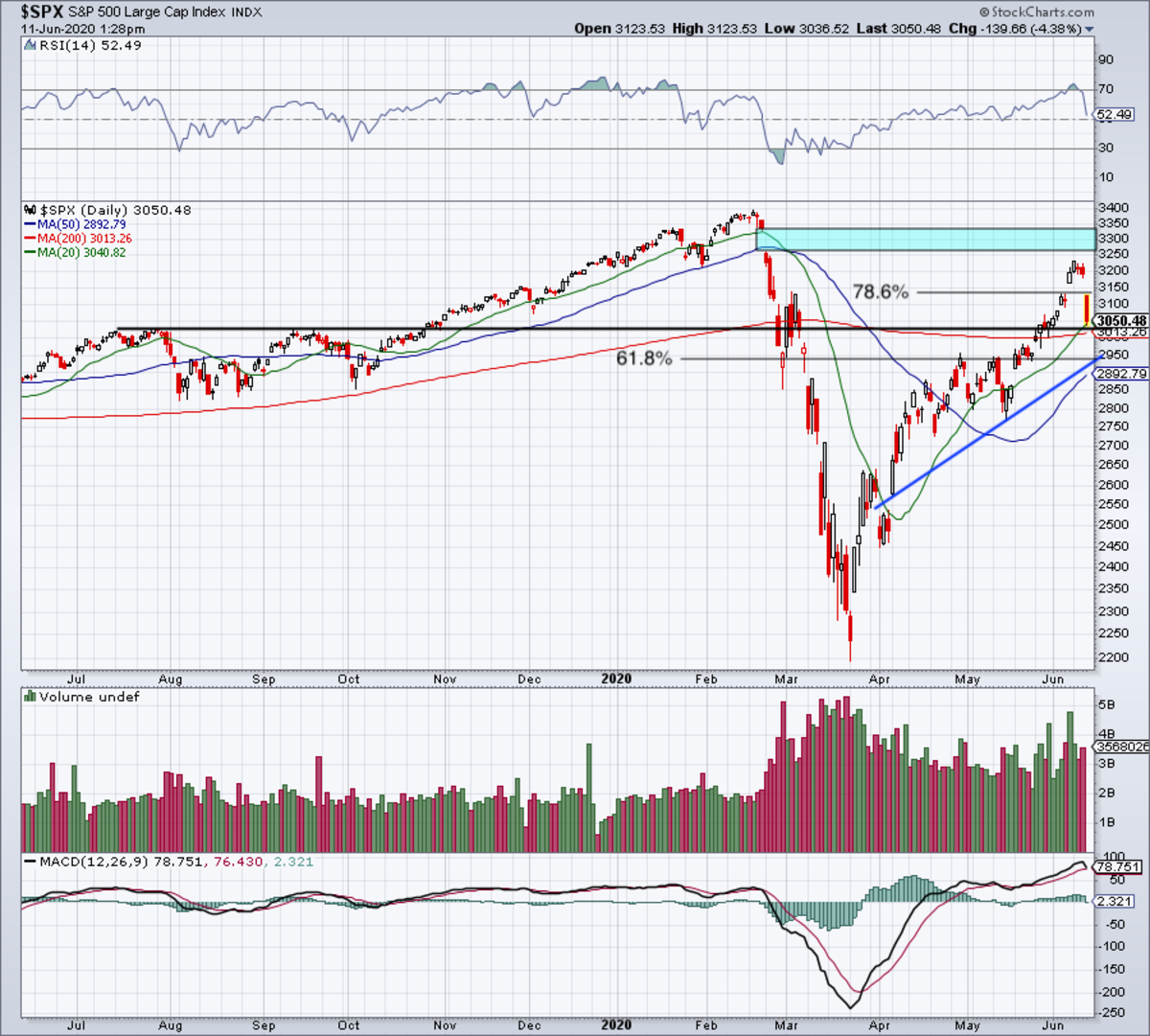

Where Will The Nasdaq S P 500 And Dow Find Support And Resistance Here S Our Take Qqq Spy Dia Nasdaq Intraday Trading Supportive

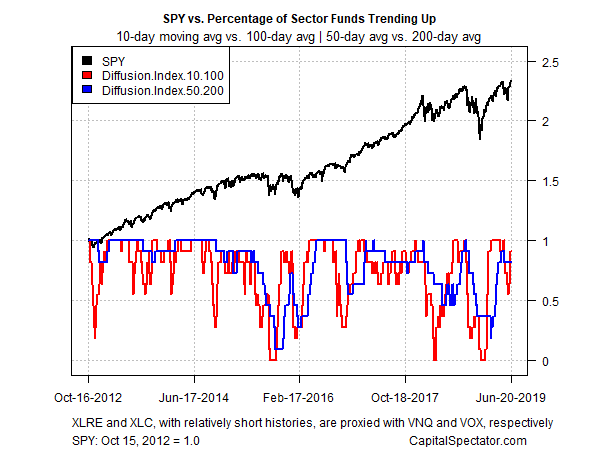

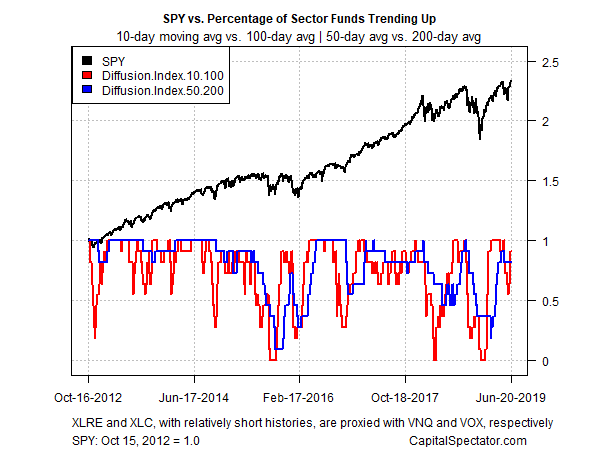

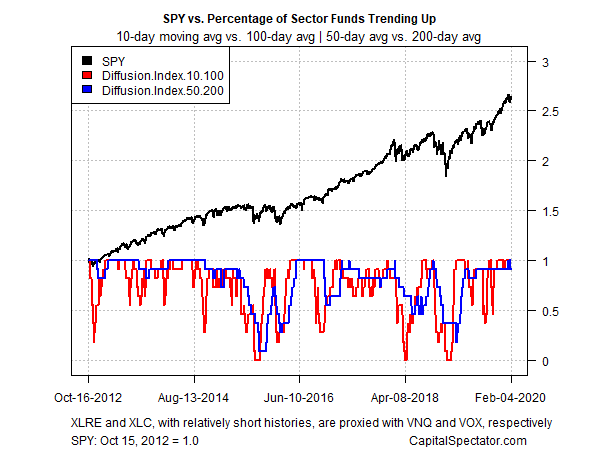

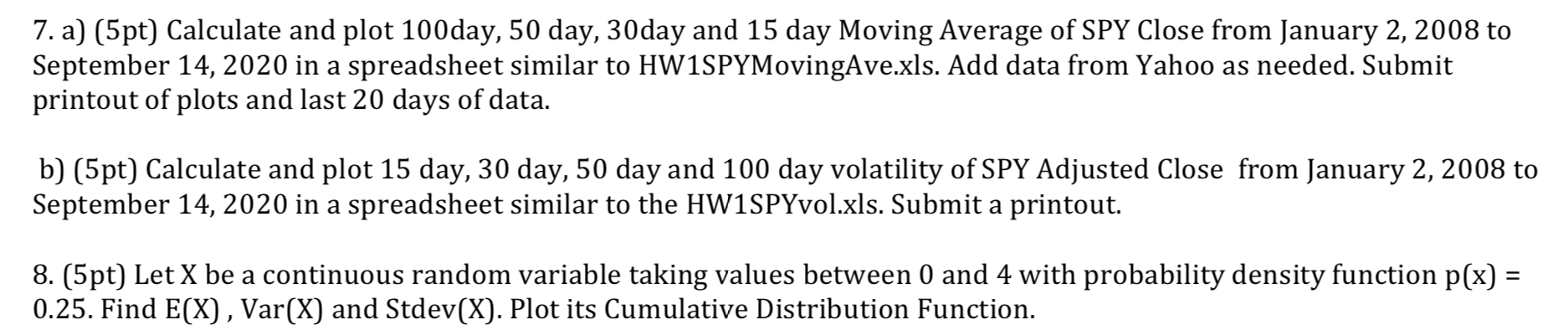

James Picerno Blog Tech Shares Back On Top For 19 Us Equity Sector Performance Talkmarkets Page 2

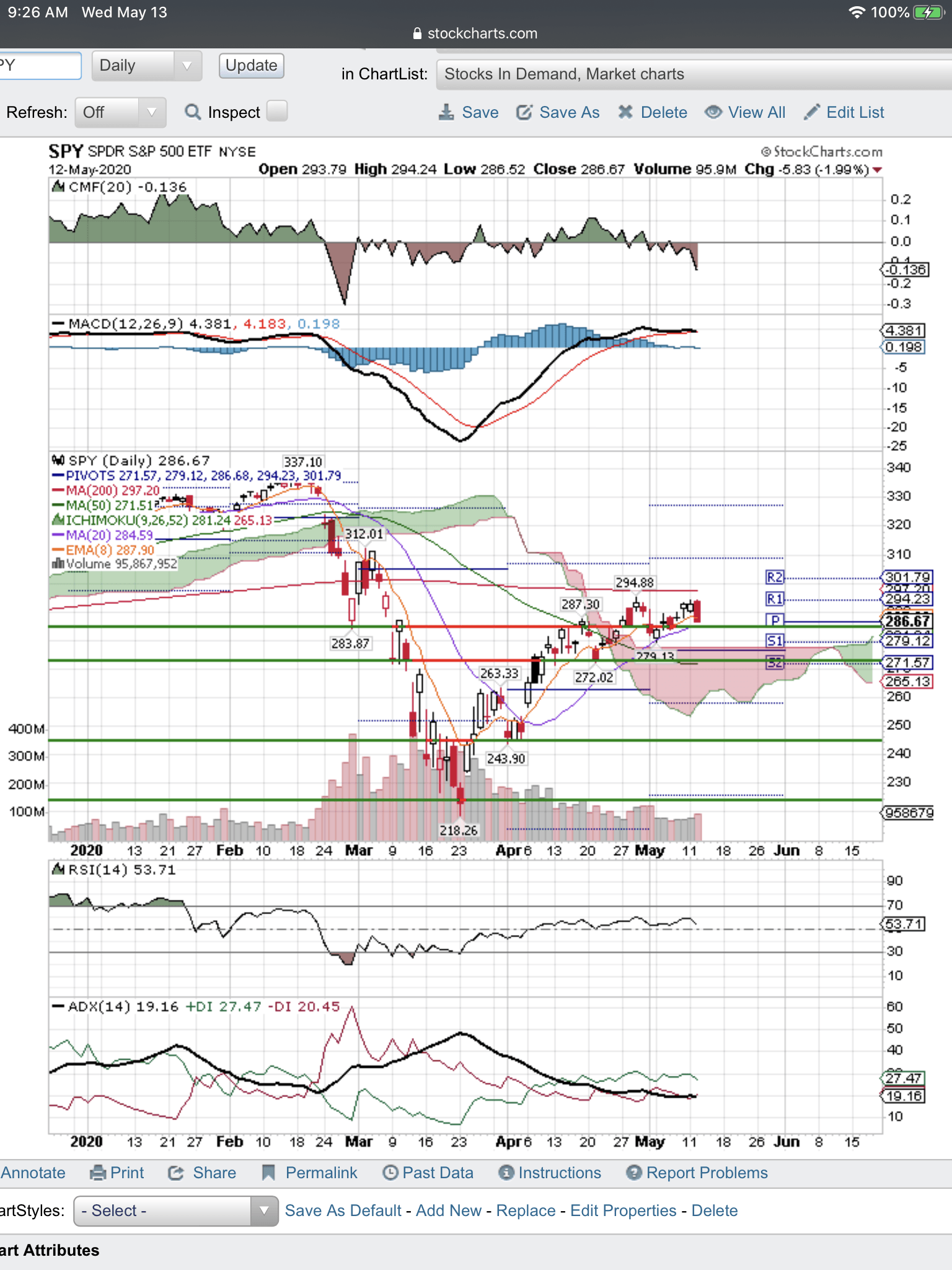

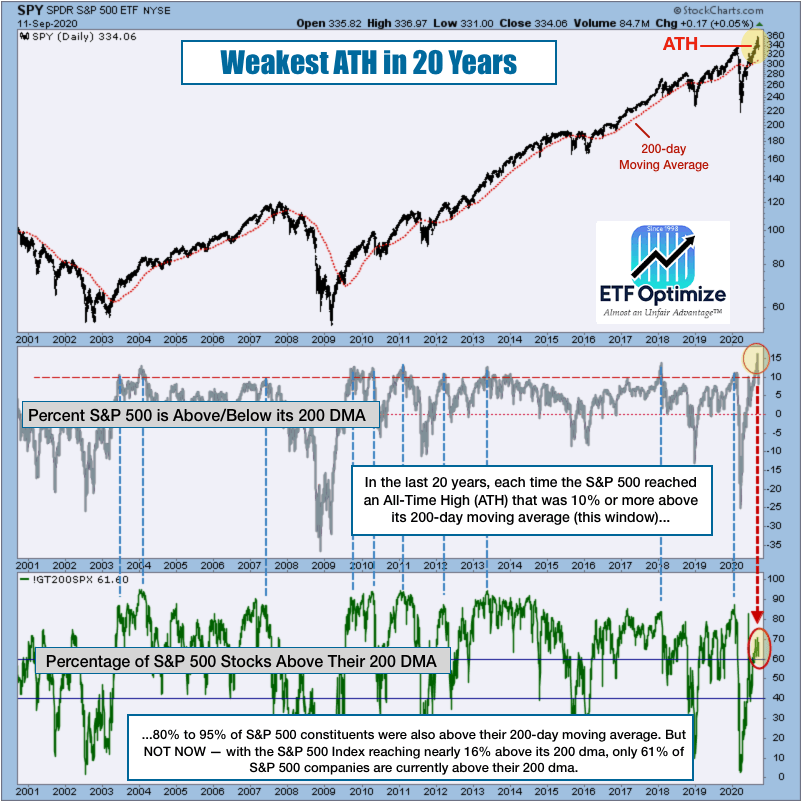

0 point is very important because last spy was broke down as it went down to 0 point and came all the way down to 181.

Spy 100 day moving average. Let's rewind the clock back to the Brexit in June 16. A) (5pt) Calculate And Plot 100day, 50 Day, 30day And 15 Day Moving Average Of SPY Close From January 2, 08 To September 14, In A Spreadsheet Similar To HW1SPYMovingAve.xls. Forget the 0-day moving average.

Today we will go through 6 tips for how to use a 50-day moving average. The following table lists the current closing daily price and current 50 and 0-day moving averages for each of the 30 stocks in the Dow Jones Industrial Average. On October 21, the SPDR S&P 500 ETF (SPY) closed at $3.04, above its 100-day moving average of $197.80.

338.93 -16.07 -4.69% :. A caution phase is when the 50-day moving average is above the 0-DMA and the price sits between both moving averages. Above that, and the 50-day moving average is in play.

8 & 21 Day Moving Average Case Study III:. Let’s take a look at the Nasdaq 100 ETF (QQQ) and the S&P 500 ETF (SPY. Just to be representative of the strategy, and it also corresponds closest to the 0 day moving average.

The 0 day moving average is a technical indicator used to analyze and identify long term trends. These traders will buy when price dips and tests the moving average or sell if price rises and touches the moving average. Other major consideration is spy is also heating 100 day simple moving average after a 5 month period and closed above the 100 day simple average.

10 Unit SMA crosses above 100 unit SMA. The 0 day moving average is a long-term indicator. If it falls this far it would be a drop of 22% from its all-time high.

Top Stock Trades for Tomorrow No. Let’s take a simple backtest of how buying SPY when the 2-period RSI was below on the daily chart. In theory, the direction of the moving average (higher, lower or flat) indicates the trend of the market.

Notice how the second longest streak just ended towards the end of October. This list shows which stocks are most likely to have their 50 day SMA cross above or below their 0 day SMA in the next trading session. This means you can use it to identify and trade with the long-term trend.

0-day Moving Average is widely used to analyze major market trends. For different-day moving averages, you just take the average of however many days. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

Essentially, it is a line that represents the average closing price for the last 0 days and can. Weekly chart with 0-day moving average highlighted. It uses last 0 days or 40 weeks data to analyze the movement of stock prices.

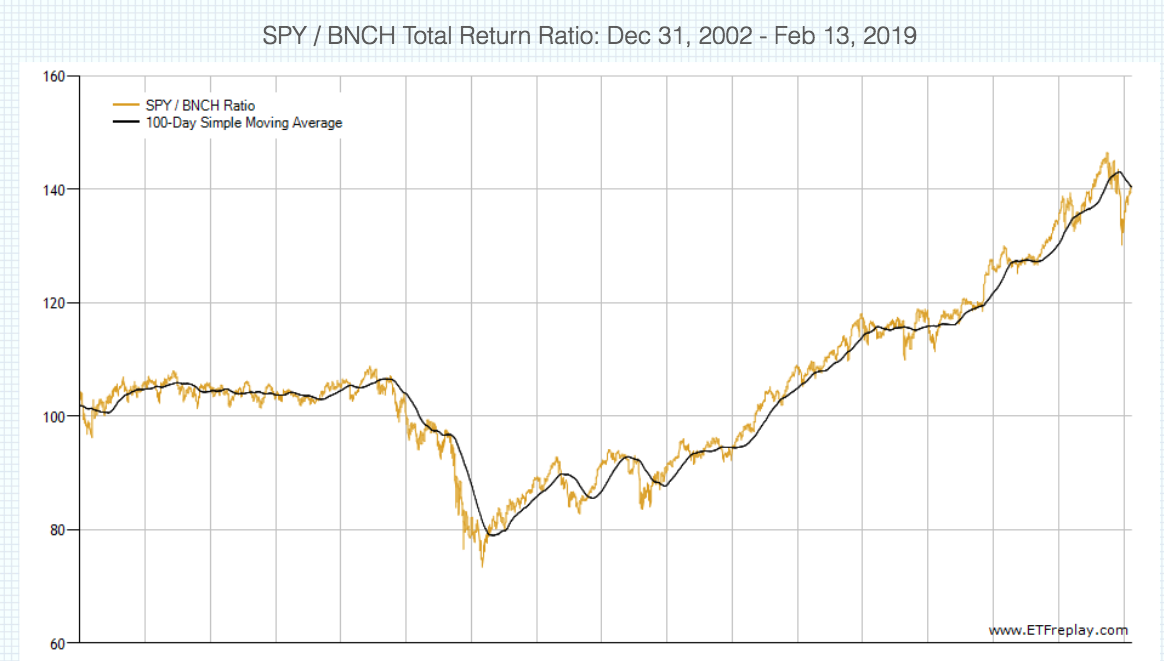

We chose monthly since daily data does not go back that far for many of the asset classes. It closed below its 50-day and -day moving averages of $6 and $3.90, respectively. The 0-day moving average is currently about -6.9% lower than the 50-day EMA, so dropping to that level would effectively double the loss since the All-Time High (ATH) set on September 2 at 358.

A shorter moving average, such as a 50-day moving average, will more closely follow the recent price action, and therefore is frequently used to assess short-term patterns. That is how moving averages are created. Joe Terranova explains why.

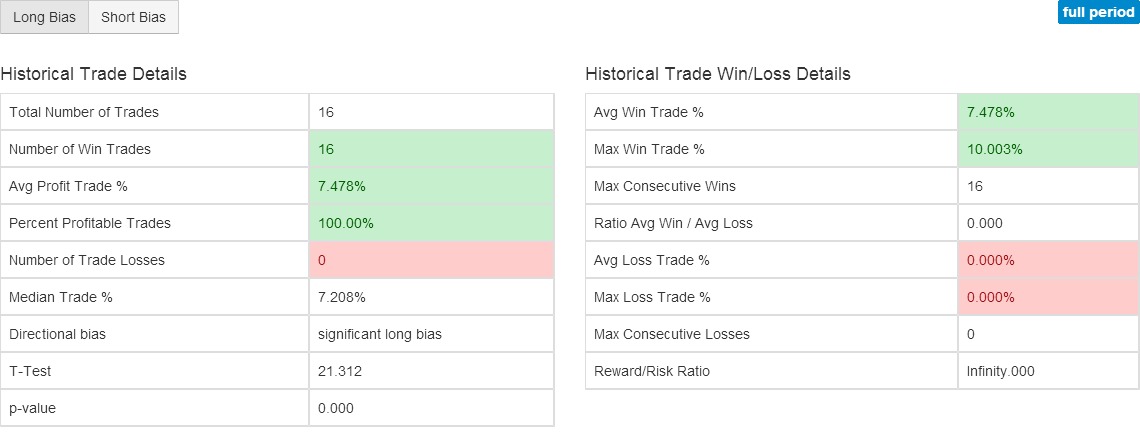

Here are the results:. While the 50-day moving average may appear to offer support or resistance to price, it is an illusion. This is an important trading signal for institutional traders.

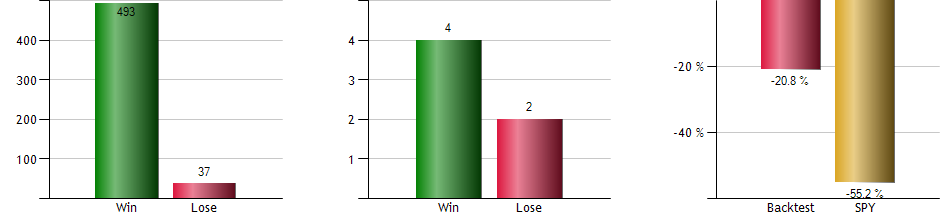

If that happens and we bounce off of that support I will get more aggressive with my longs. Over the past ten years, this system would have produced an average annual return of 5.73%. If the price is below the 0 day moving average indicator, then look for selling opportunities.

342.25 -8.23 -2.46% :. This is a technical indicator of the average closing price of a stock over the past 0 days. The idea of only owning stocks above the 0-day moving average has been around for a long time.

Suncor Energy’s 50-day moving average is 10% below its 0-day moving average. Here’s a look at the 15-minute chart of GBP/USD and pop on the 50 EMA. S&P 500 ETF (SPY).

I've shown this case studies in several webinars and training events, and I bet I'll be teaching it 10 years from now. 5 Tips for Using a 0-Day Moving Average 1) Make sure the price action respects the 0-day moving average. Buyers are starting to gain confidence.

I’m not expecting a big market decline, but we could see the low from last week tested. There is no best moving average although shorter length averages will be more sensitive to price shocks. On the upside, let’s see if SPY can rally to its 100-day moving average.

To find out if we're really out of the woods its the 400-day moving average that matters. On the downside, though, it has the prior breakout level near $300, the 0-day moving. Where did you get your historical data?.

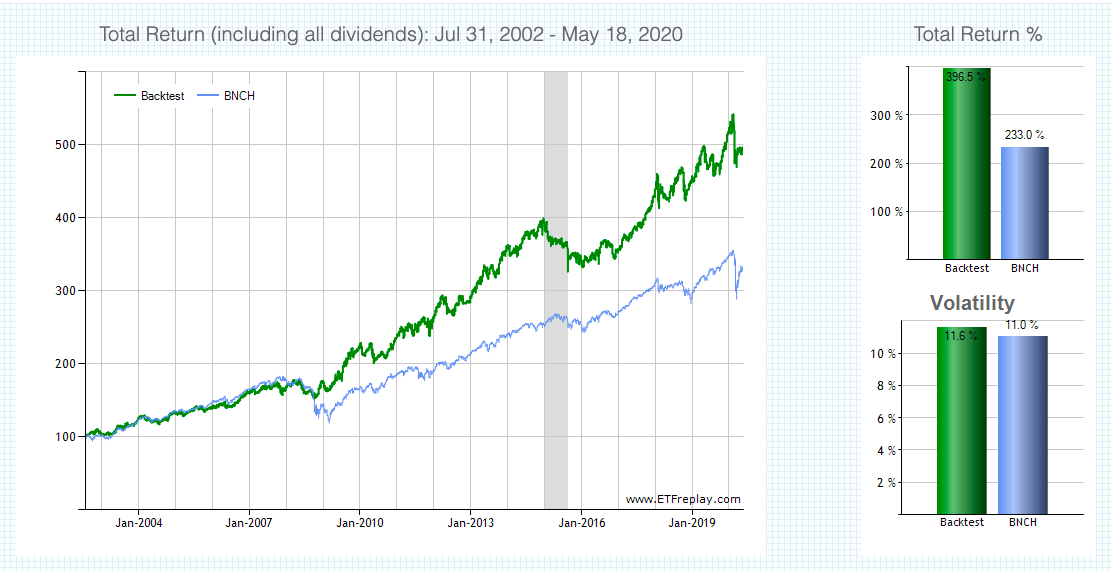

2-day RSI of SPY > 65;. This return is slightly below the 6.58% return that could have been gained through a buy and hold approach to the SPY. The SPY Post-Brexit Classic.

This is because the average acts like a floor (support), so the price bounces up. 0-day moving average (.34) 50-day moving average (279.62) Source:. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

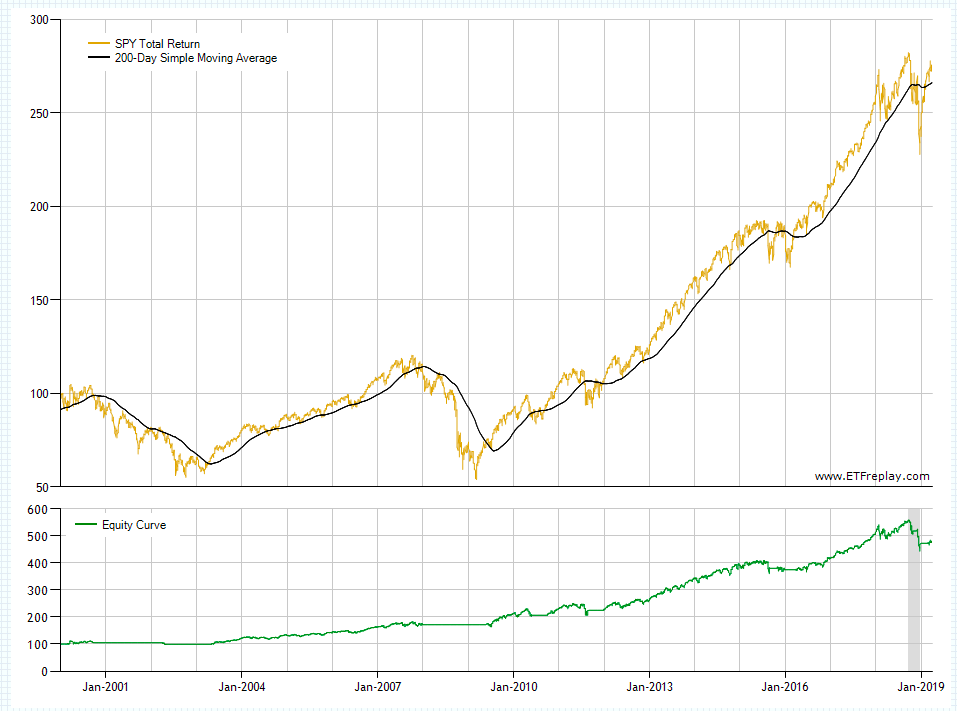

(i) go long the S&P 500 SPDR ETF (SPY) whenever the index closes above the 0-day moving average and (ii) go short whenever the index closes beneath. First off, here’s a list of the longest streaks with a rising 0 day moving average in SPY. A moving average is green if the current price is above its moving average.

Period Moving Average Price Change Percent Change Average Volume;. Submit Printout Of Plots And Last Days Of Data. There are many forex traders out there who look at these moving averages as key support or resistance.

Other moving averages can be of varying length, such as 50-day, 100-day, etc. A couple of thoughts As The Yuan Turns, and as we hover near the 0-day simple moving average in the SDPR S&P 500 ETF Trust (SPY):. Add Data From Yahoo As Needed.

Whenever the price is above the 0-day moving average, a whole assortment of good things usually happen, such as the asset appreciating in price, low volatility, and so on. The 100 day moving average takes the closing prices of the day for the last 100 days. 0-day Moving Average is a long-term trend-following technical indicator.

Now with the market still undecided, we can build a plan on what to look for if we break under the 50-day moving average. Here’s how… If the price is above the 0 day moving average indicator, then look for buying opportunities. The chart below is a weekly chart for the S&P 500 ETF (SPY) with two simple moving averages that approximate the 50 day (10 weeks) and 0 day (40 weeks or 10 months) moving averages.

Before you do anything with the 0-day moving average, you first need to see if the traders controlling the stock care. In an uptrend, a 50-day, 100-day or 0-day moving average may act as a support level, as shown in the figure below. On the upside, though, see if the stock can reclaim its 100-day moving average.

I kind of go on this. To confirm the caution phase, the price needs to close below the 50-DMA for 2 consecutive days. Looking at the chart above, SPY's low point in its 52 week range is $232.51 per share, with $286.58.

That number gives the price of the moving average for the day. The chart below shows the one year performance of SPY shares, versus its 0 day moving average:. The 10-month exponential moving average (EMA) is a slight variant on the simple moving average.

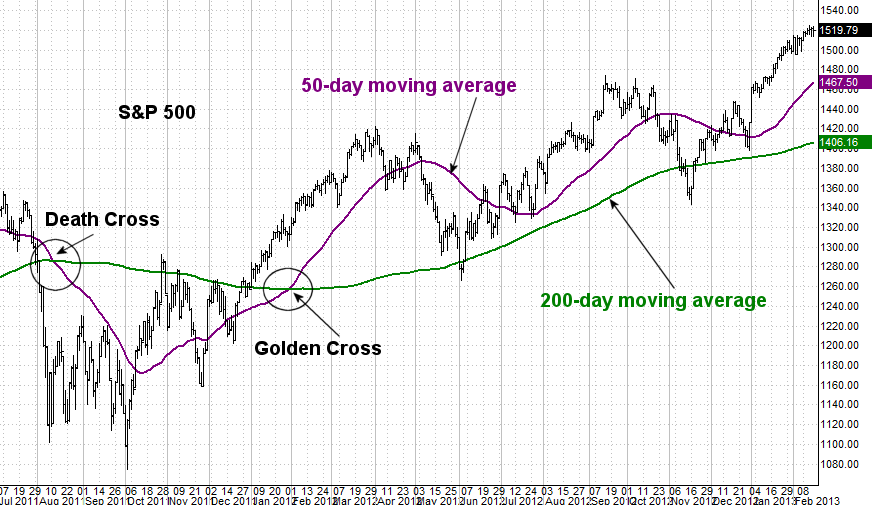

A longer moving average (such as a 0-day EMA) can serve as a valuable smoothing device when you are trying to assess long-term trends. The 0-day moving average support is 2,637 or 11% below its current value. When the 50 day SMA crossed below the 0 day SMA, it is called a "death cross." When the 50 crossed above the 0, it is called a "golden cross.".

QQQ and IWM gapped lower, closing in an unconfirmed caution phase, while the SPY and DIA have already confirmed a caution phase. The chart below of the S&P Depository Receipts Exchange Traded Fund (SPY) shows the 50-day Simple Moving Average and the 0-day Simple Moving Average;. In any stock, there are the traders which are controlling the price movement.

10 Unit SMA crosses below 100 unit SMA. Above that puts $3 on the table. This Moving Average pair is often looked at by big financial institutions as a long range indicator of market direction:.

Well, the 50 is a multiple of the 100 and 0-day moving averages. In particular, SPY settled nearly flat with its 160-day moving average on Monday, June 3-- the low close of its current 160-day outing, at which point its return for the streak had nearly. Those numbers are added up and divided by 100.

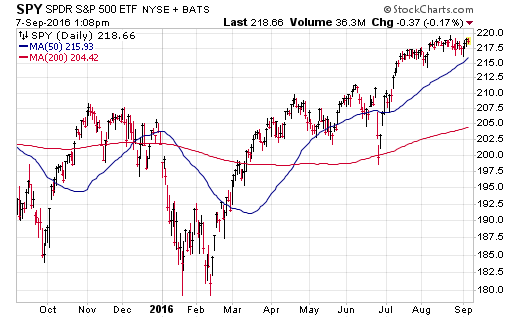

We’ll discuss the SPDR Dow Jones Industrial Average ETF (DIA) and the SPDR S&P 500 ETF’s (SPY) moving averages. These results can look deceiving because a simple buy-and-hold of SPY outperformed the. The day before the Brexit vote, the SPY hit $210.87.

Why the 50-day moving average and what makes it so popular?. Current price of SPY > 100-day simple moving average;. 2-day RSI of SPY < ;.

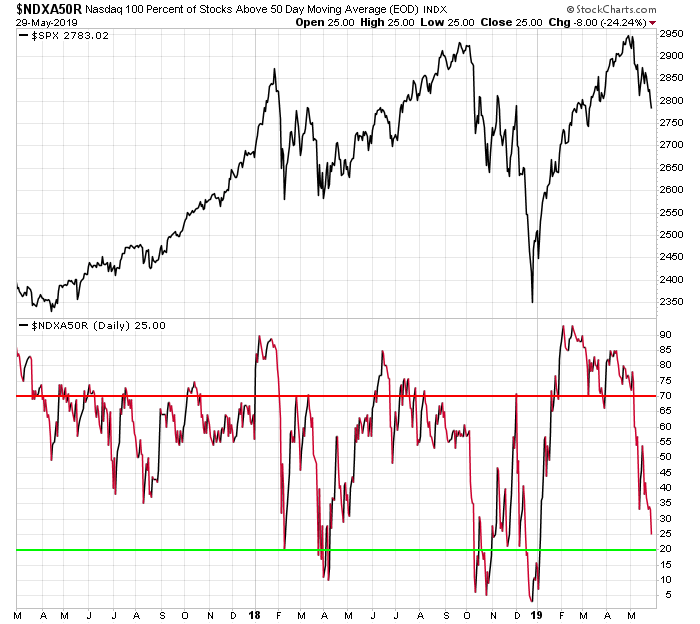

For the major indices on the site, this widget shows the percentage of stocks contained in the index that are above their -Day, 50-Day, 100-Day, 150-Day, and 0-Day Moving Averages. Since 1995 it has produced fewer whipsaws than the equivalent simple moving average, although it was a month slower to signal a sell after these two market tops. I rarely care much "why" the market moves.

The 0-day moving average isn't just something recently cooked up, either. What software did you use to perform the historical backtests?. If the stock breaks technical support or if the SPY closes below the 100-day moving average, buy the spreads back.

Whether you are using the 50-day, 100-day or 0-day moving average, the method of calculation and how the moving average is interpreted are the same. First, why do we care about the 50-day moving average?. It is red if the current price is equal to or below the moving average.

Short term traders usually use a 10, -period moving average while longer-term players use the 50, 100, and the 0 day. The S&P 500’s moving average The S&P 500 index (SPY) was trading at 2.7 at the end of the ay on March 16, recovering from its earlier low of 181.0 on February 11, 16. That is done every day.

The strategy I tested had just two triggers:. Knowing a large amount of people and institutions watch these levels makes for a self-fulfilling prophecy when price reacts to these averages. The 50-day moving average indicator is one of the most important and commonly used tools in stock trading.

To trade the S&P 500, I’m using the SPDR S&P 500 ETF - Get Report.Currently, the SPY is sitting right on its 0-day moving average and just above the major fourth-quarter breakout level at $300. This version mathematically increases the weighting of newer data in the 10-month sequence.

Spy Coiling Between 50 100 Day Moving Averages Alphatrends

Spy Reaches 0 Day Moving Average What Next For Amex Spy By Daniel Urdaneta Tradingview

State Of The Markets In 5 Charts September 16 Edition Investing Com

:max_bytes(150000):strip_icc()/GoldenCross-5c6592b646e0fb0001a91e29.png)

Golden Cross Definition

Spy Crosses 100 Day Moving Average On October 21 That S Positive Market Realist

How Does Xbi Compare To Its 100 Day Moving Average

:max_bytes(150000):strip_icc()/2018-12-14-DeathCross-5c13eaf0c9e77c00013499e4.png)

Death Cross Definition

Chris Ciovacco S P 500 S 100 Day Moving Average 19 Present Details Here T Co Nd4dj5xg7o Spx Spy

0 Day Moving Average What It Is And How It Works

Buy The Wintel Trade In The Coronavirus Correction Stock Investor

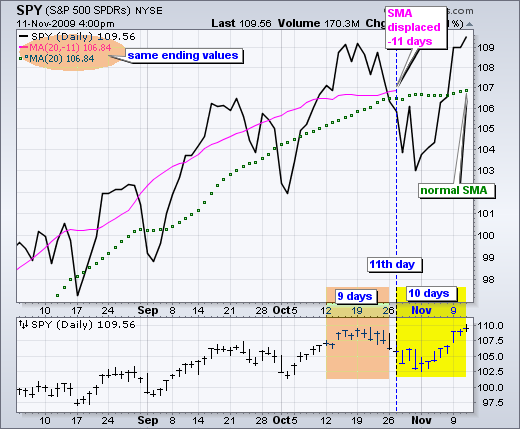

3 Ways To Use Moving Averages In Your Trading

3 Reasons To Buy Spdr S P 500 Nysearca Spy Seeking Alpha

Charting Market Cross Currents S P 500 Maintains 0 Day Average Marketwatch

Z2jrvr72 Jjt M

Market Bears Resurface S P 500 Balks At The Breakdown Point Marketwatch

Using Pmi Data For Tactical Asset Allocation Backtestwizard

Has The Technology Sector Run Too Far Too Fast

Lighten Up On The Nasdaq 100 Qqq Thestockbubble Com

Market Direction And Trends Knowing When To Add Risk And When To

Moving Average Price Crossover Trading Strategy Algorithmictrading Net

Key Charts In Equities Harvest

Tech Soars Energy Sinks So Far In Equity Sector Horse Race The Capital Spectator

4 Top Stock Trades For Thursday Msft At T Pton Spy Investorplace

S P Volatility Ahead Of Monthly Option Expiration Nysearca Spy Seeking Alpha

Moving Average Trading Strategies Do They Work

Cla Ic Options As We Highlighted The Markets Found Support Near The 100 Day Moving Average A Bounce Felt Around The Markets Today Spy Spx Vix Qqq Fed T Co Bi6xop5weg

:max_bytes(150000):strip_icc()/2018-12-14-FBDeathCross-5c1400eb46e0fb0001418b74.png)

Death Cross Definition

Wealthpress Daily 4 9 18 Wealthpress Financial Publishing

Detrended Price Oscillator Dpo Chartschool

Charting A Bearish Technical Tilt S P 500 Dow Industrials Violate Major Support Marketwatch

Silver Is Finally Following Gold S Lead By Breaking Out To The Upside

The Four Most Common Indicators In Trend Trading Forex Trading

12 50 And 100 Dma Spy Moving Up Still But Moving Up More Slowly Credit Flow Investor

Trade Of The Day Just Buy The S P 500 Spy Etf Investorplace

/2018-12-14-DeathCross-5c13eaf0c9e77c00013499e4.png)

Death Cross Definition

Spdr S P 500 Trust Etf Trend Indicators Looking Stronger Nysearca Spy Seeking Alpha

Spy At The Critical Bull Bear Juncture Nysearca Spy Seeking Alpha

/2018-12-14-DeathCross-5c13eaf0c9e77c00013499e4.png)

Death Cross Definition

Mechanical Trading Of Channelling Swing System Ppt Download

Moving Averages Explained A Useful Introduction For Novice Traders Commodity Com

Money Movers Report Global Markets Up On First Day Of New Quarter China U S Trade Talks Continue In D C This Week Money Movers Report

Moving Average Trading Strategy That Crushes Buy And Hold New Trader U

Short Term Lows Coming Spy Qqq Dia Eem Next Big Trade

Spy Crosses 100 Day Moving Average On October 21 That S Positive Market Realist

Charting A Fragile Market Recovery Attempt S P 500 Reclaims 0 Day Average Marketwatch

Stock Market Update If The 50 Day Moving Average Breaks See It Market

Why The Spy 160 Day Moving Average Matters

Stock Market Update If The 50 Day Moving Average Breaks See It Market

If The S P 500 Falls Below These Levels Watch Out Below

The S P Moving Average To Watch Amid 0 Day Panic

Moving Averages Golden Cross Death Cross In Technical Analysis

S P 500 At A Critical Inflection Point Nysearca Spy Seeking Alpha

Moving Averages Explained A Useful Introduction For Novice Traders Commodity Com

Sector Detector Central Banks Take Center Stage As Stocks Seek A Catalyst Sabrient Systems

An Algorithm To Find The Best Moving Average For Stock Trading By Gianluca Malato Towards Data Science

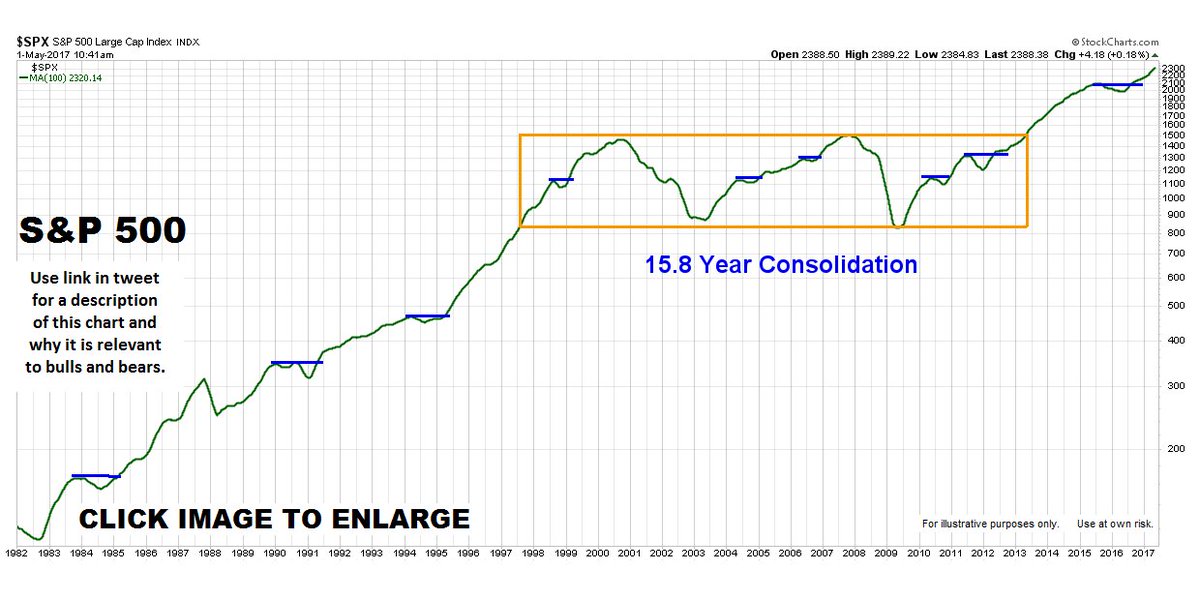

2 Simple Charts To Monitor The S P 500 Nysearca Spy Seeking Alpha

Yesterday Was Rough For Most Traders But This Strategy Thrived Daily Profit Machine

Did The Stock Market Peak Let S Check The Charts Thestreet

Cla Ic Options Vix Testing 100 Day Moving Average Spy Spx Vxx Qqq Shop Nvda Tsla Iwm Baba Uso Ung

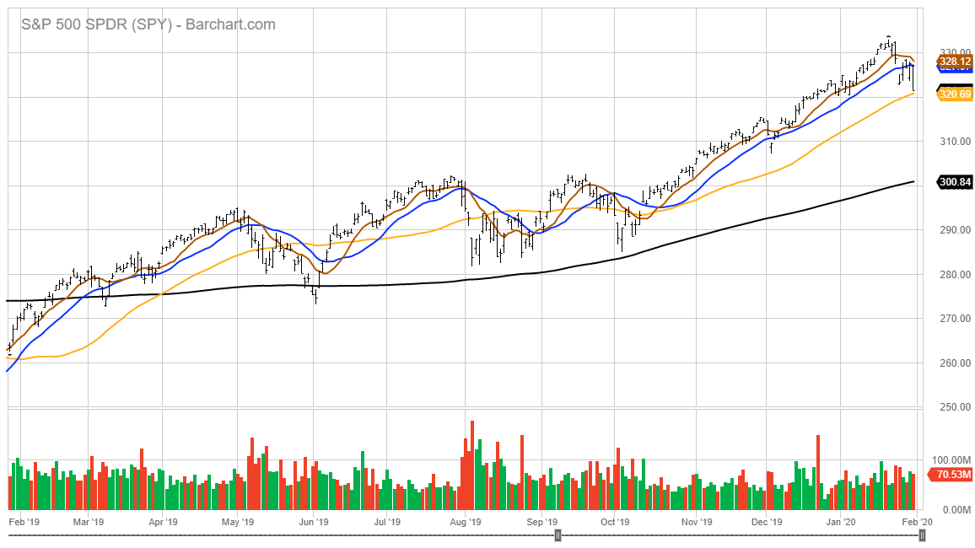

Spy 100 Day Moving Average Charts S P 500 Spdr

Sabrient Systems Blog Bulls Hold The Line As Market Coils In Anticipation Of A Bigger Move Talkmarkets Page 2

How To Use Moving Averages To Improve Your Trading Trendspider Blog

Pharma Stocks Show A Positive Trend

Nxgh E9 Z529bm

Technical Tools For Defensive Value Investors Gurufocus Com

The S P Moving Average To Watch Amid 0 Day Panic

0 Day Moving Average What It Is And How It Works

7 A 5pt Calculate And Plot 100day 50 Day 30d Chegg Com

Spy Vs S P 500 Above 0 Day Moving Average For Index S5th By Cosmicdust Tradingview

Spy Macd Turn 0 Ma Bounce Over Mas Previous High Test Boo For Amex Spy By Curtmelonopoly Tradingview

U S Equity Factors Continue To Post Wide Ranging Results In Seeking Alpha

Rotationinvest Com Blog

A Hidden Key Intermarket Relationship Top Shelf Traders

How To Beat The Market In The Long Run With Trend Following Strategies Nysearca Spy Seeking Alpha

Pwhup7bcy3snfm

System Trading With Woodshedder Page 58 Just Another Weblog

The S P Moving Average To Watch Amid 0 Day Panic

Why The Utilities Sector Topped Spy

3 Ways To Use Moving Averages In Your Trading

Spy 9 Years Of 50 Day Vs 0 Day Moving Average Crosses For Amex Spy By Timwest Tradingview

Using Pmi Data For Tactical Asset Allocation Backtestwizard

How Does Xbi Compare To Its 100 Day Moving Average

S P 500 At A Critical Inflection Point Nysearca Spy Seeking Alpha

Growing Fears Of A Stock Market Crash

:max_bytes(150000):strip_icc()/MarginDebtDEC2018-5c631b6ac9e77c000159c9f6.jpg)

Reduce Holdings As The S P 500 Tests Its 0 Day Sma

Your Week Ahead Daily Profit Machine

Charts And Technical Analysis Stop Loss Traders

0 Day Moving Average What It Is And How It Works

Markets Lower Behind Global Trade Uncertainty And Tariff Escalation Tradespoon

If The S P 500 Falls Below These Levels Watch Out Below

Fodopostotrading The 377 Day Moving Average

Short Sellers Be Prepared For A Countertrend

/dotdash_Final_Strategies_Applications_Behind_The_50_Day_EMA_INTC_AAPL_Jul_2020-01-0c5fd4e9cb8b49ec9f48cb37d116adfd.jpg)

Strategies Applications Behind The 50 Day Ema Intc pl

Former Market Bull Says Charts Are Flashing A Warning For Stocks